‘Tis the season to get scammed! With billions of dollars swirling around the internet, it's no surprise that credit card fraud would be on the rise.

One of the more unorthodox things I do is get credit card transaction notifications via email. On any amount greater than $0.00.

That's right, I get every last transaction.

Why do I do this? It started on a whim. I was thinking about how to build a do it yourself identify theft system and found this feature in my Chase Southwest card. You can set it to notify you for any transaction over $X – where you set the X.

So I set it at zero!

I've heard a lot of scam stories. A lot of them are people getting ripped off for small amounts, like $5 and $10 over a long period of time. It works because they don't notice.

Sometimes, scammers like to do little test transactions to see if the card is real. If the little charge goes through, then they go after the big stuff or they sell the information to someone else.

I figured that if I set it up like this, I'll know about fraudulent charges immediately and I can dispute the charges with the credit card company.

In a little revisionist history, I started saying I like to know when my credit card is being used… because after a while, I kind of did. The notifications happen near instantly too. By instantly, I mean I sometimes I get the notification before the server has come back to the table with my card!

That's how fast the notification arrives.

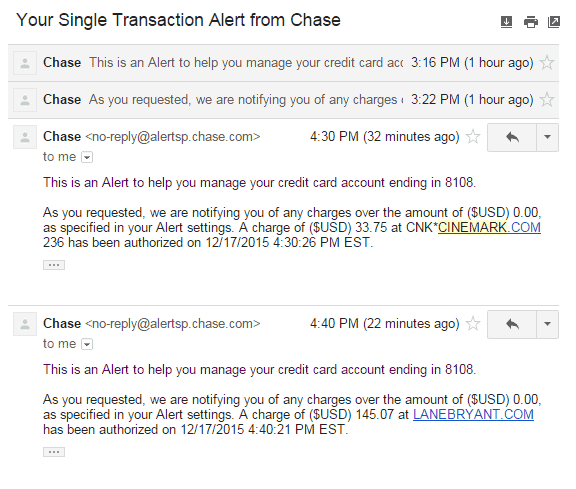

So imagine my surprise when I get these two emails about charges I didn't know about!

Great! The system it's working!

It was the holidays, my wife and I share a credit card to maximize our rewards, and so it's possible she purchased from these vendors as gifts. Except they're not because my lovely wife is sitting right next to me and told me she never made these purchases. Fraud!

I call up Chase, get transferred to their fraud department, and learn that these were made online from Pennsylvania. The call took all of 9 minutes because I didn't have to sift through a list of transactions trying to guess what is legitimate. I knew exactly what I was disputing.

Added bonus? I'll be getting a card tomorrow via express mail because it's our daily use card (that's a term you have to use if you want next day delivery of a new card, otherwise it goes regular mail).

If your card offers it, you should sign up for transaction notifications.

It sounds extreme until you realize you probably don't use your card as much as you think and it has the added bonus of reminding you of subscriptions you might not use all that often.

Win-win.

How to Setup Transaction Notifications

In general, each credit card company sets it up in a similar way – through their alerts system at the account level. You typically have to log in, go to your profile, and find the area that controls alerts. Once there, you can give them permission to email you, text, or even Apple notify you of transactions.

Below, I've explained how to do it for American Express, Chase, and Citi because we have their cards.

American Express

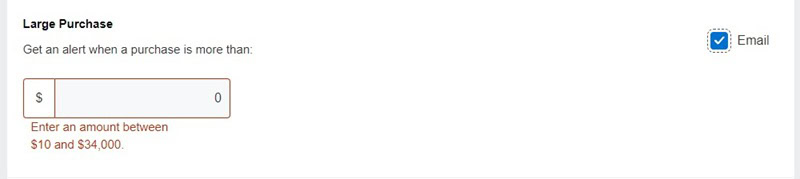

American Express will let you get a notification via email on a transaction but only if the amount is greater than $10. This means that smaller transactions won't trigger it and there's no way to set the amount lower.

To do this, go to Account Services -> Alerts and Communications Preferences -> Account Alerts. Then, scroll all the way down to the Large Purchase alert.

Chase

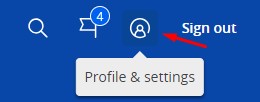

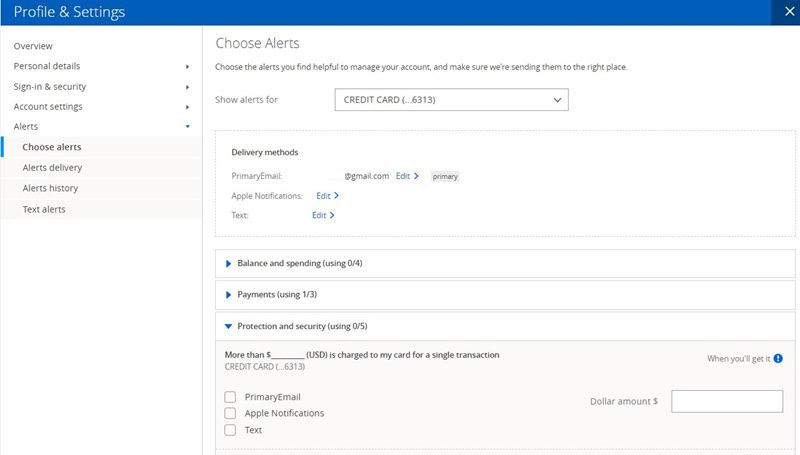

For Chase cards, it's all managed through Profile & settings. Log into your account and click on the Profile & settings link at the top right, it's the circle with a person in it:

Then, in the left menu, you want to go to Alerts and “Choose alerts.” Transaction notifications is located under Protection and security:

You can set it to send you an email, Apple notification, or text whenever you get a charge (I set it to $0 so I get all transactions). You will have to do this for each card separately.

You can get notification for:

- More than $__________ (USD) is charged to my card for a single transaction

- An international charge has been posted to this account

- An online, phone or mail charge is authorized on my credit card

- A gas station charge is authorized on my credit card

- A credit is pending on my card account

Citi

For Citi, click on your Profile in the upper right and go to Account Alerts.

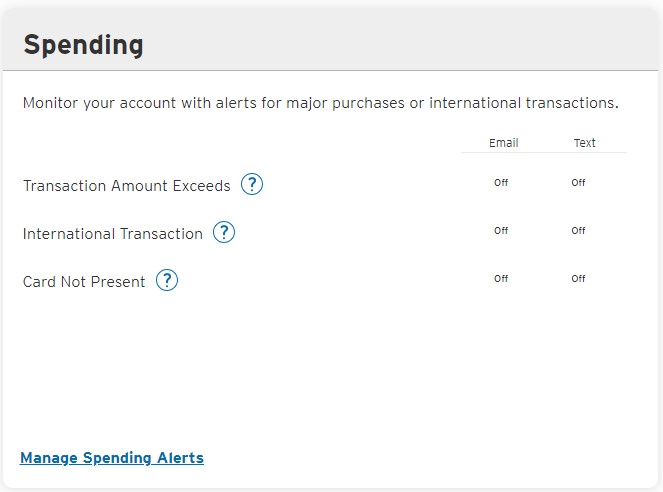

Then, scroll down until you see the Spending box on the left and you can manage those alerts:

Click through and you can set these values. You can set the transaction alert to $0.00 so that you get all transactions.

Love this tip! I use transaction alerts also but never set the threshold to zero. Will try it out.

I thought I was going to get a deluge, then I realized that would only happen if I make a ton of transactions. 🙂

I have the Southwest Visa too, and have alert set up, need to double check my alert threshold. Great tip!

Thanks Brian — you can set it to $0, I was surprised. All the credit cards I have will let you get alerts.

Love this! Just set it up for my Wells Fargo VISA card. They require a min of $1.00 or more, but that’s still a winner.

That’s awesome! $1 is a good enough minimum, I can’t remember the last time I got a charge under a dollar (not counting iTunes).

Th8is is a really cool idea. I’m going to have to lower my threshold from $500 to zero.

Thanks Fred! I thought about what my threshold would be and thought why not try $0… then these two hit and I realize a $100 limit would catch one and not the other (and I probably wouldn’t have noticed Cinemark if I reviewed my transactions, since we occasionally go to movies). $0 isn’t that bad normally, but it does get tricky during the holidays. 🙂

I use this for my checking account because I’m more worried about that one than a credit card. Credit card fraud is a bit less urgent. I think I set mine to > $0.01 since I didn’t think I could do > $0.00!

I think $0.01 and $0.00 are functionally equivalent. 🙂

A long story for you: My wife has a slight spending problem so I had set up these alerts for anything over $100 to try to combat her spending habits. I was at work around 10am and got an alert that we spent $711.42 at a Walmart store near our house. I quickly called my wife and she didn’t answer. It was possible she had to buy something for work, but unlikely. I called another 10+ times, no answer. Then I used FindMyiPhone and was able to see she was at work still. I quickly called the police where the… Read more »

Mike… this is the most insane story I’ve ever heard. Thank you for sharing it but this is incredible!

Wow! I wonder if I can do this on all of my cards. This is an excellent tip. Glad I read this.

Some have minimums of $1 but every credit card I own will offer email or text notifications.

Hi….liked your story on card alerts. My Chase visa card was recently transferred by Chase to a Barclay’s Mastercard. I had the same alerts from Chase….loved them. So I set up alerts with Barclay’s for email. These alerts take minimum of 24 hours to receive and they do not show vendor…only the amount so you have to remember all charges. I called Barclay’s customer service and was told notifications are sent right after charge is made. No idea why emails are taking so long. Am thinking to go back to Chase. Any advice?

That’s weird that Barclays would say they send them immediately but don’t reach you for 24 hours – if that’s a deal breaker, consider moving for sure!