Debt, like many financial tools, is a double-edged sword. As a student loan, it can be a low-interest way to pay for school. Like a credit card, it can give us financial flexibility, though at a great cost if we don’t pay it off each month. A mortgage gives you the ability to buy a home without having to save up the money beforehand.

In all instances, there are positives and negatives.

When it comes to high-interest debt, you must work towards paying it off as quickly as possible.

I’ve been fortunate to have avoided high-interest credit card debt. I didn’t overspend on credit frivolously and I was lucky enough to not face financial hardships that force many to turn towards debt for necessities. Double-digit interest rates on debt, regardless of size, can be a big weight on your finances.

What if you could swap high-interest debt for lower interest debt?

If you have enough equity in your home, it’s very possible.

Should I consider it?

Before we discuss the pros and cons, what to watch for, and other topics — the biggest question is if it’s even possible.

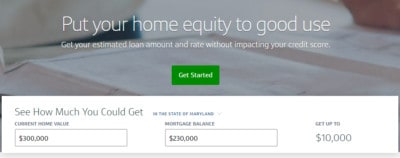

Do you have equity in your primary residence? Using Capital One’s quick calculator can help you find out.

Next, do you have enough debt? This may seem like a strange question but banks typically don’t give out small home equity loans. The smallest amount I’ve seen is around $10,000, but most banks have a minimum of $20,000 to $25,000. The debt doesn’t have to all be in one place, with a home equity loan you get the loan in a lump sum and can distribute it on your own.

Will you have the discipline to pay off this loan faster than you would have the original? Home equity loans can be for long periods, up to 30 years. A loan of 30 years at 6% will cost you, in interest, about as much as an 18% loan over 10 years. If you will be diligent about paying it off, shifting to a lower interest loan can be a good option.

Pros and Cons

If you continue to make the old credit card payment amounts to your new lower interest home equity loan, you’ll be able to pay off your debt much faster.

Another advantage is that a home equity loan is a fixed-rate loan – your interest rate will never change. Credit card interest rates fluctuate and that unpredictability can wreak havoc on your budget and financial plan.

Finally, the interest you pay on a home equity loan is potentially tax-deductible. You can deduct interest on up to $100,000 of home equity debt when you itemize your deductions (subject to limitations based on income). Credit card interest is not tax-deductible.

Are there disadvantages?

The one that jumps out at me is that if you shift unsecured debt, like a credit card, to a home equity loan, you’re shifting unsecured to secured. If you fail to pay a credit card debt, your credit score will suffer. By shifting that debt to something secured, the debt is backed by an asset (in this case your house).

The other drawbacks are associated with the behaviors that might have caused the debt in the first place. When you shift your debt to a lower interest rate, your monthly payments will go down. This will give you the illusion of greater purchasing power.

If you’re the type that will see the new lower monthly payment but still pay the original amount, fantastic! If you’re not and instead will just spend the money, or rack up more debt, on this now 0% balance credit card, then you’re only delaying the inevitable – and now putting your home on the line.

What to look for in a HEL

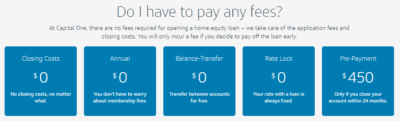

There are two things to keep an eye on — the closing costs (including an application fee) and whether there’s a pre-payment penalty. A home equity loan is very similar to a second mortgage so you’re getting a loan with a set period (up to 30 years) and most banks have a minimum amount, typically $10,000.

Capital One offers home equity loans with zero closing costs, no annual fees, and has loans for terms of 5, 10, 15, and 20 years. There is a pre-payment penalty if you close your account within 24 months, though there’s no pre-payment penalty for residents of Texas.

Many banks may charge application fees, closing costs, and other fees related to the loan because it is so similar to a mortgage. It’s not uncommon to see a property or title-related fees, so be sure to ask about these when doing your research.

What about other consolidation options

Using a home equity loan to pay off debt is not the only way to consolidate loans, but you will find that it’s probably going to be the cheapest.

At the time of this writing, I researched the cost of personal loans and quoted rates were much higher. This makes sense because a home equity loan is backed by your home, a personal loan is backed by nothing.

When you consider all the factors (fees, rates, tax deduction), a home equity loan is often the best option.

Final Note

This post was fairly general and ultimately you will need to do the math to see whether it’s a good option for you.

Fortunately, there are plenty of tools available to you.

This post was sponsored by Capital One but the words and thoughts are my own. Whether you’re remodeling your home, consolidating debt, or looking to pay off something big, Capital One is here to help with smarter tools that give you the knowledge to choose the right options for your situation. If you want to give their tools a look, I invite you to visit CapitalOne.com/Home-Equity. You can also call 855-446-9656 or stop in a branch for more information.