Earlier this week, I polled over twenty financial experts about how you should invest your first $1,000.

One common theme among their answers was that you should consider a low cost investment, usually an index fund of some kind.

That recommendation is nearly universal and it's for a very simple reason —

The most important number in investing is the fee.

The more you pay in fees, the less you'll have in your investment for it to grow!

It sounds tragically simple. Almost too simple.

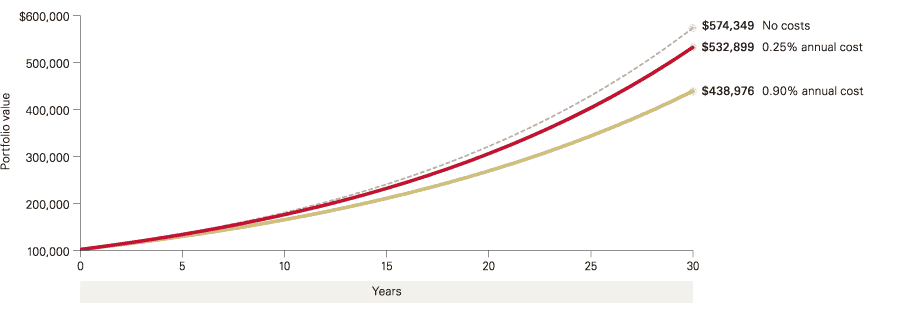

Even small differences in fees can have huge differences in your wealth because of how long your investments will grow. Take a quick peek at this chart from Vanguard, which looks at a $100,000 initial investment with a 6% reinvested return:

A small difference becomes a huge difference in 10, 20, and 30+ years!

Review Your Fees Right Now!

Retrieve the prospectus of all your funds and see what your fees are, the important ones are:

- The expense ratio – that's how much the fund will charge you each year in fees.

- The sales load (sales commission) – the commission when you buy or sell the fund. A front-end load, or front load, means you pay a fee when you buy the fund (this is on top of any transaction fee you may pay). A back-end load is a fee you pay when you sell shares of the fund and usually has a time decay. For example, if you sell shares within 5 or 10 years, you're charged a back-end load but if you wait beyond that period, there's no back-end load. A deferred load is a fee you pay when you sell shares of the fund and has no time limit, but typically gets lower the longer you hold shares.

- Finally, no load means no sales commission.

Now compare those fees with what you can get at a low-cost company like Vanguard or Fidelity.

Would you be shocked to learn that Vanguard's S&P 500 Index Fund (VFIAX) only charges you 0.04% with no load?

Fidelity's 500 Index Fund (FXAIX) charges a 0.15% expense ratio with a $0 minimum.

Oh, did I mention that many of the low-cost brokers don't charge administrative or other account maintenance fees? Vanguard doesn't. Fidelity doesn't.

Don't Overpay

The key takeaway from this post isn't that you should shed all other investments and plow your money into low-cost index funds.

You should still hold diversified investments and sometimes those investments will be expensive.

Vanguard has a Vanguard Explorer Fund which aims to invest in small U.S. companies with growth potential. Higher risk, higher reward, but also more expensive. The Investor Shares have an expense ratio of 0.49%. It invests in smaller companies, which is something you won't get from an S&P 500 Index fund.

If you want international exposure, it'll cost you more.

The lesson isn't to go cheap, it's to go cheap when the cheap option performs just like an expensive one!

Here's an example — I don't understand why anyone is invested in the Rydex S&P 500 fund (RYSOX). It seeks to match the performance of the S&P 500 but charges an expense ratio of 1.60%! (oh, it also has an initial sales commission, front load, of 4.75% — that's insanity!)

You can't predict the future. You won't know how your investments will fare. But you can control how much you pay. Never overpay.

(this is also why anything you need in the near future should be kept in a safe short term investment)

As the old adage goes, fund your retirement, not your broker's!

It’s amazing how many people have never even thought to check their investment fees! In fairness, many companies don’t make the information as accessible as Vanguard does. 🙂

I always find it surprising but if you’ve never researched it then you probably didn’t realize fees vary. It’s not uncommon to look in your 401k, see a dozen options all with fees north of 1%, and think that’s the way of the world. 1% is not unreasonable on its own, it becomes unreasonable when you can get the same product for a fraction of the price… that’s when you’re getting ripped off.

It is all about focusing on things I can control. I can control somewhat how much I save, how much I end up paying in taxes and fees, and what I invest in. In my case, buying a dividend stock triggers a small one-time commission. And then as long as I hold it ( along with all the other companies I own), I never have to pay any charges/fees again. If I am smart enough to put that money in a Roth IRA, then I won’t have to pay taxes either. But I do not understand either why anyone would… Read more »

I think people just don’t think about it. They see the fee, they see their options, and they just pick one. Then someone mentions… hey, you’re paying 10x what you should in fees. Why?

Then they start asking questions…

That Rydex fund is ridiculous! Sadly many Americans are invested in funds that are nonsensical and expensive like that and they have no idea.

I’m a big fan of Vanguard I use them for my Roth IRA and thankfully my 401k and HSA have great Vanguard options as well. Especially for indexing, there is no reason to go anywhere else.

Indeed. Fees can cost you Millions.

Exhibit A: http://www.physicianonfire.com/investment-fees-will-cost-millions/

Exhibit B: http://mebfaber.com/2016/05/18/institutional-asset-allocation-models/

A fund like RYSOX should not exist. It is superfluous and detrimental to investors. A wonderful real-life example of the Gotrocks parable.

I manage my own money and have an overall weighted average expense ratio of 0.08%. Thank you, Vanguard!

Best,

-PoF

RYSOX is unconscionable.

I can’t believe that RYSOX even has a market. But you know they are partnered with some 401k company and that is the only index fund that employees have to choose from…

Is that how they get people to give them money?

I would say the most important number is *how much* you invest – that makes all the difference in the world! If fees were #1 you’re better off investing $0.00 as you’d pay nothing 😉

I think it’s safe to make the assumption that if someone is interested in investing, they already know that the amount you invest is more important than anything else. The only way they’d be unaware of that is if they lacked a fundamental understanding of numbers. 🙂

So if we give them that, the NEXT important number is how much it costs. 🙂

I think you give us too much credit, haha…

Great article! I like that you focused on fees, as these are the seemingly small numbers that are often overlooked, but that actually (as you pointed out) begin to add up over time. Thanks for the wonderful advice!

centsai.com

Death by a thousand cuts!

Did you see that Personal Capital study that looked at advisory fees among different companies? Merrill Lynch came out to $930,000 in fees over 30 years with a $500,000 account. So insane! I compared a few other companies too. Generally speaking if you hold an account at least five years, the Wall Street firms like Morgan Stanley / Merrill are the most expensive, load funds 2nd, local fiduciaries 3rd, the waaaay down the list comes Vanguard and then Betterment / Wealthfront.

Link to Personal Capital study: https://www.personalcapital.com/assets/whitepapers/PC_Fees_WhitePaper.pdf

A lot of this comes down to awareness. I believe people fundamentally understand that things cost money. People need to be paid so they, in turn, can put food on the table. But when they overcharge, in the case of some advice (RYSOX!!!!), that’s when it needs to be stopped.

Definitely scary how what appears to be a tiny difference in fees can make such an enormous difference to the value of your investments in the future! It could certainly be the difference between early and not so early!