At one point, I once had over a dozen checking accounts. (which is too many bank accounts)

I was doing reviews for my previous personal finance blog and since opening a checking account didn't hurt anything, I kept opening them and reviewing them.

After a few years, I had a dozen checking accounts. I'd have ten bucks here, twenty bucks there, and it was a total mess.

It was awful.

As I started closing them, I realized that I didn't have a good idea of how any of my accounts were connected.

Which bank account was automatically paying my credit cards?

Which bank account was connected to my Vanguard account?

For the checking accounts, I didn't care. I was closing them.

But for the important accounts, I had no idea and that was a problem.

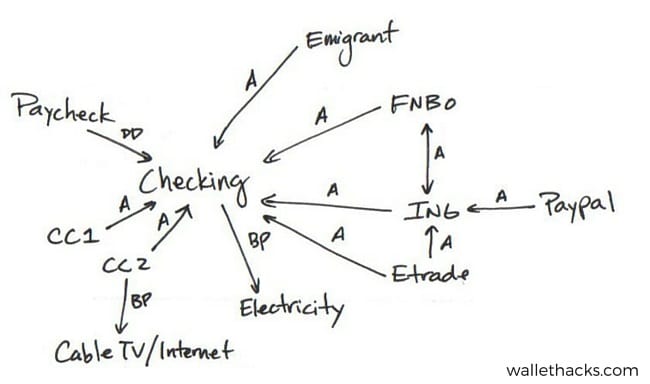

So I did what any engineer would do, I drew a map.

You can draw your map however you like, I think it's best to go with something intuitive, but mine was relatively simple:

- Start with a list of all of your accounts – bank accounts, brokerage accounts, credit cards, Paypal, Dwolla, etc.

- Then add in all of your bills and services – cable TV/internet, utilities, Netflix

- Now draw arrows between them indicating a link – The side with an arrowhead meant I had to log into that account to draw money from the other. I'd use acronym for the link type – A for ACH transfer, BP for bill pay, DD for direct deposit.

- Remember to update this as your accounts change

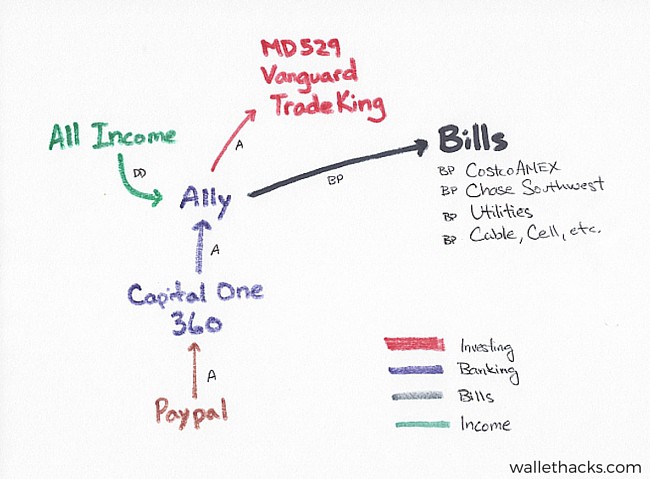

Now that you have the financial network map, prune it. Chances are there are things in there that don't make any more sense and you can close down those accounts and adjust the map so it's simpler.

And if you haven't done it already, it's time to put together a Treasure Map to put into prose everything you know in your head.

Here's what our financial network map looks like today (with color coding!):

despite it being acquired by Ally Bank in early 2016)

Complexity can be a source of problems and a cognitive weight you don't need, so make your life simpler.

Fortunately, you have a map to show you how! 🙂

Oh, before you go – if you are looking to simplify your finances, our handy guide can help you figure out how to best do that.

If you aren't, here are a few banks offering hundreds of dollars in bonuses for you to open an account!

Visio seems like a natural tool for doing this. But not everyone has that. What tool do you use?

I just draw in one of the tabs of Excel that I use to store/record net worth right now, but Visio would be good too. The only reason I don’t use paper is so that it’s all in one place.

Using Excel makes sense.

I tried OneNote but settled on Word because with the Drawling Canvas, you can add Text Boxes and connect them with arrows that “stick” to the boxes. It also has a number of group positioning and alignment tools. Very similar to Visio, but more portable for my needs.

You should try the free website draw.io

it lets you draw schema like visio but it’s online and free and you can save it as .xml so you can edit later and you can output it as image, pdf, etc… excellent tool

Great tool! Personally, I like to keep it as simple as possible and try to avoid recommending tools that might add a barrier. Pen and paper to start but this is certainly a useful tool when you’re done and want to create something digital (and editable, vs. my photos!).

Mindmeister is also a great option!

I’ve never used Mindmeister but it looks very elegant.

Very interesting article Jim. I found this article from Paula’s recent article. I have actually taken the opposite route with brokerage accounts, and have more brokerage accounts than the average individual. Since I ask myself what could go wrong, I have decided to have some redundancy in that area. I call this process stress testing my dividend portfolio. The goal is to have my money protected by SIPC insurance ( plus different accounts serve different purpose – 401K for employer at one place, SEP for solo stuff, Roth at another place, taxable at a few other institutions). I do not… Read more »

You make a good point on having redundancy, I didn’t consider the potential for my broker (TradeKing or Vanguard) to go under or get frozen, but I applied this principle with banks, especially during the recession. There were some large banks that went under and while the FDIC got folks their money within a couple days (usually close the bank on Friday, reopened by Monday), it can be a harrowing few days!

I like the simplicity behind the map and less accounts. Less is more. I am always puzzled when it comes to sub-savings accounts. IE: Investment Acct, Car Savings, Tax Savings, Emergency Fund, etc. What do you recommend on that? I use Capital One 360 Savings and I like your approach to less is more and can see just having 1 savings so less “messy”. Thanks!

Derrick

I like multiple savings accounts for goals, just exactly as you describe, but on a map and in records, like my Net Worth Record, it’s listed as a single account.

Great article Jim, once you have a map established you can automate everything so it’s much easier to keep straight which account pays which. Also agree on the multiple savings accounts, just started that with Ally Bank and find myself more motivated to push towards each goal (i.e. vacation fund, car fund) and save more than I was in the past.

I’m a huge fan of checklists and taking things out of my head and onto paper, this is another example of it.

And before you automate anything, it’s crucial to simplify it down to the core essentials or you’re just automating a bad system!

This is why I like that CapitalOne360 lets you have so many subaccounts. All incoming goes to my main account and I can link any outgoing I need to to it. I can keep the complexity in the savings accounts instead.

Yes exactly!

Makes me want to close all the accounts I have and just move everything to Vanguard. Would make my map so much simpler

Simpler is better! 🙂

Great article. Practical and simple. The free version of XMind can easily help the mapping.

I have a Wealth Management firm, and I am learning many tips from you. Quite a few of my clients like your tips. Thank you very much!

Lucy

Thanks for sharing them Lucy!

Thanks Jim. Its nice to know theres still people who do things for others without any monetary gain!

Well, to be honest, there’s never absolutely no monetary gain. Even this post, which isn’t for monetary gain, exists to build up a blog, that is for monetary gain (among other things!). Nothing is solely for monetary gain though.

Hi Jim: Thanks for your emails. I try to read all my emails when I get a chance. Sometimes I find leads to answers I don’t have. I am retired Canadian and I spend most of my time in my second home in Costa Rica. (the winters aren’t as cold as Canada). I have traded stocks with TD Waterhouse for many years, but have never traded or learned how to trade options. It does not seem too complex, but I want your insight if you are willing to share it. I don’t want to dive into something I know little… Read more »

Hey Steve – I don’t mess with options, my investing is boring and in index funds (with a little dividend growth stocks thrown into the mix).