TJX Rewards Credit Card Review

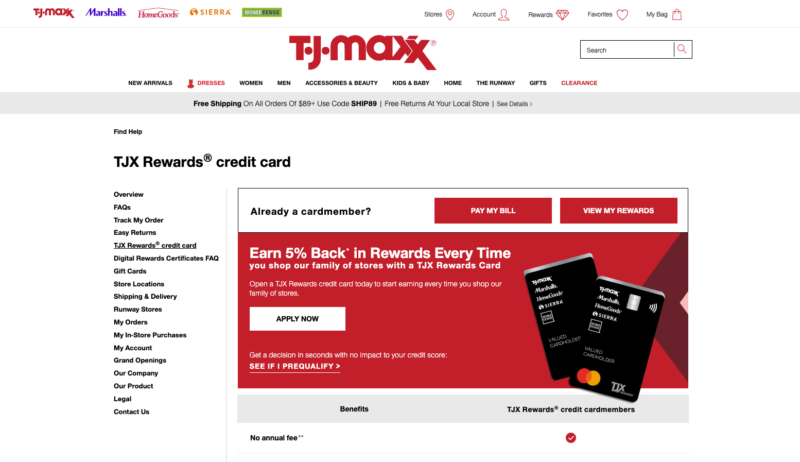

Product Name: TJX Rewards Credit Card

Product Description: The TJX Rewards Credit Card is a merchant credit card that rewards you for shopping at T.J. Maxx, Marshalls, HomeGoods, Sierra, and HomeSense stores. Other benefits include 10% off your first card purchase and monthly sweepstakes entries.

Summary

The TJX Rewards Credit Card is a merchant credit card that rewards you for shopping at T.J. Maxx, Marshalls, HomeGoods, Sierra, and HomeSense stores.

Overall

Pros

- Earn 5% cash back shopping at any one of the five store chains in the T.J. Maxx family

- Get a 10% discount on your first purchase

- Rewards are redeemable within 48 hours of earning them

- No annual fee

Cons

- Rewards can only be earned and redeemed on purchases within the T.J. Maxx retail family

- The Purchase APR is higher than general-purpose rewards cards

The TJX Rewards Credit Card is a credit card that rewards you for shopping at T.J. Maxx, Marshalls, HomeGoods, Sierra, and HomeSense stores. Other benefits include 10% off your first card purchase and monthly sweepstakes entries.

The card might fit your wallet well if you are a regular T.J. Maxx customer or shop at one of its popular subsidiaries. However, other credit cards offer similar rewards and benefits from more retailers, so it’s worth comparing before you make a final decision.

At A Glance

- Earn 5% back at T.J. Maxx family of stores

- No annual fee

- 10% off your first purchase

- Monthly sweepstakes entry (chance to win a $100 Gift Card)

Who Should Use This Card?

Because it is a store credit card, the TJX Rewards Credit Card is best suited for consumers who regularly shop at T.J. Maxx or its family stores. It’s important to emphasize that this is not a general-purpose credit card and cannot be used for ordinary purchases, like paying for gasoline, groceries, restaurant purchases, or shopping in unrelated retail outlets.

Some customers who apply for a TJX Rewards credit card will qualify for the TJX Rewards Platinum Mastercard, which can be used wherever Mastercard is accepted. However, this review focuses on the store card.

T.J. Maxx Credit Card Alternatives

|  |  | |

| Annual Fee | $0 | $0 | $0 |

| Purchase APR | 20.49% to 29.24% variable APR | 29.95% variable APR | 19.49% to 27.49% variable APR |

| Rewards | 5% cash back on travel through Chase Travel, 3% on dining, takeout, and delivery, 3% on drugstores, 1.5% on all other purchases | 5% discount at Target and Target.com, 2% cash back on dining and gas purchases, 1% on all other purchases | Earn up to 5% back on Amazon.com, Amazon Fresh, Whole Foods, and Chase Travel purchases, 2% at gas stations, restaurants, local transit, and 1% back on all other purchases |

| Learn More | Learn More | Learn More |

Table of Contents

- At A Glance

- Who Should Use This Card?

- T.J. Maxx Credit Card Alternatives

- What is the TJX Rewards Credit Card?

- 5% Rewards at the T.J. Maxx Affiliated Stores

- 10% Rewards Bonus Upon Card Approval

- How to Redeem Rewards Points

- Credit Card Fees & Pricing

- How to Sign Up for This Card

- T.J. Maxx Credit Card vs. Alternatives

- FAQs

- Summary

What is the TJX Rewards Credit Card?

The TJX Rewards Credit Card is the merchant card for T.J. Maxx, the leading off-price apparel and home fashion retailer in the U.S. T.J. Maxx operates thousands of stores under that name and several partner brands. As a result, the T.J. Maxx Credit Card, commonly known as the TJX Rewards credit card, is one of the most valuable store credit cards available today.

As mentioned, the card is limited to retail outlets within the T.J. Maxx family of stores and cannot be used for general purchases elsewhere. Here’s a closer look at the card’s key features and benefits.

5% Rewards at the T.J. Maxx Affiliated Stores

TJX Rewards cardholders earn 5% rewards on card purchases at any store within the T.J. Maxx family.

This includes:

- Marshalls,

- HomeGoods,

- HomeSense, and

- Sierra.

The 5% rewards level applies to in-store and online purchases.

When you sign up for the card, you must also open an account with T.J. Maxx. By linking the card with your account, you’ll receive Rewards Certificates at the purchase points, and those rewards will become available within 48 hours of completing your purchase.

You can apply Rewards Certificates automatically when you checkout or manually by hand-keying the CSC number of the Rewards Certificates you want to redeem.

Rewards are accumulated at five points for every $1 spent at a T.J. Maxx retail outlet or online purchase. For every 1,000 points earned for making purchases with the card, you will be eligible for a $10 rewards certificate.

Certificates can be issued in either $10 or $20 denominations.

✨ Related: Stores That Give You Cash Back at Check Out

10% Rewards Bonus Upon Card Approval

When T.J. Maxx approves your card, you’ll get a welcome bonus of 10% off your first purchase. Be careful, however, since the coupon will only be redeemable for purchases on the T.J. Maxx website if you sign up for the credit card online.

Applying for the card will affect how you can use the 10% rewards bonus, and it gets tricky. The bonus can be used online or in-store if you apply and are approved for the card using a desktop or tablet. But if you apply and are approved through a mobile device, the rewards can only be used in-store.

Card benefits include special discounts, like private shopping events and discounts on select merchandise. You’ll be alerted to these events through exclusive shopping invites.

How to Redeem Rewards Points

You can view your accumulated rewards points anytime by visiting the TJX Rewards Section under My Account. You can print your rewards certificates to redeem them for in-store purchases or access digital rewards certificates on the T.J. Maxx brand apps and the .com site.

Digital rewards certificates can also be redeemed for in-store and online purchases. Whether the certificates are paper or held in your account digitally, a cashier can scan and redeem them.

✨ Related: Best Credit Cards to Use at Costco

Credit Card Fees & Pricing

T.J. Maxx’s Credit Card webpage does not disclose fees and interest rates. However, based on the Synchrony Bank/T.J. Maxx Credit Card disclosure, the current APR for purchases and cash advances is 34.99%. The rate is higher than that of a standard Visa or Mastercard but comparable to most merchant credit cards.

There is a late fee of up to $38 but no annual fee. The cash advance fee is the greater of $10 or 4% of the advance taken.

How to Sign Up for This Card

You can sign up for the T.J. Maxx Credit Card from a desktop or mobile device. You’ll start by entering the last four digits of your Social Security number and your mobile phone number.

Once you sign up for the credit card, you must create a tjmaxx.com account. You can then link your credit card account to access your Rewards Certificates digitally. The rewards will be available at checkout at any T.J. Maxx store, and rewards certificates are available within 48 hours.

T.J. Maxx Credit Card vs. Alternatives

One of the fundamental limitations with the T.J. Maxx Credit Card – or any merchant credit card, for that matter – is that rewards will apply only when you shop with the sponsoring merchant.

T.J. Maxx is a bit stronger than most merchants in this regard. After all, rewards accumulate from all merchants in the T.J. Maxx family, including Marshalls, HomeGoods, HomeSense, and Sierra.

But if you’re looking for a credit card that pays rewards on purchases with just about any merchant, here are a few cards worth considering:

Chase Freedom Unlimited

Chase Freedom Unlimited is one of Chase’s premier cash-back credit cards. It currently offers 5% on travel purchases through Chase Travel, 3% at drug stores and dining in restaurants, including takeout and eligible delivery services, plus 1.5% on all other purchases.

It’s an excellent choice for a credit card that can be used for general purchases anywhere MasterCard is accepted. This contrasts to T.J. Maxx Credit Card which can only be used for purchases within the T.J. Maxx retail network.

In addition to generous rewards, Chase Freedom Unlimited is also offering a Additional 1.5% cash back on everything you buy (on up to $20,000 spend in the first year) - worth up to $300 cash back . The annual fee is $0 (hard to beat that!) and your cash back rewards never expire.

Learn More About the Chase Freedom Unlimited

Target Circle Credit Card

The Target Circle Card Mastercard is another merchant credit card, much like the T.J. Maxx Credit Card, but with a twist. It can be used for purchases outside Target, and you can also earn 2% on dining and gas purchases and unlimited 1% on all other purchases.

Target actually has different cards: a credit card, a debit card, and a reloadable account, but we will focus on the credit card version.

You will enjoy a $50 credit on a future qualifying purchase when approved for a Target Circle Card. The primary benefit, however, is that you can save 5% every day on in-store purchases at Target and on Target.com.

That’s comparable to T.J. Maxx’s 5% rewards on purchases at T.J. Maxx stores. The Target Circle Credit Card has no annual fee and comes with free two-day shipping of thousands of items purchased through Target.com.

The current purchase APR on the card is 29.95% (variable). There is also a cash advance fee of the greater of $10 or 3% of the amount transferred and a late payment fee of up to $41.

Learn more in our full Target Circle Card review.

Learn More About the Target Circle Credit Card

Amazon Prime Rewards Visa

The Amazon Prime Rewards Visa is a merchant credit card issued by Chase, but like the Target Circle Card, you can use it for purchases outside the Amazon family.

You’ll receive a $100 Amazon gift card upon credit card approval. From there, you can enjoy the following rewards:

- Unlimited 5% cash back on Amazon.com, Amazon Fresh, Whole Foods, or Chase Travel purchases (Cash back is limited to 3% for non-Amazon Prime members)

- Unlimited 2% cash back at gas stations, restaurants, local transit, and commuting, including rideshare services.

- Unlimited 1% back on all other purchases where Visa is accepted.

The package gets even better. There are no annual or foreign transaction fees. You can redeem your rewards at Chase.com for cashback, gift cards, or travel. Speaking of travel, the card comes with valuable travel benefits, including auto rental collision damage waiver, baggage delay insurance, lost luggage reimbursement, travel accident insurance, and more.

Meanwhile, Amazon Prime member cardholders can earn 10% back on a rotating selection of purchases through Amazon. The APR on this card is currently between 19.49% and 27.49% on purchases and balance transfers. The late fee is up to $39, and balance transfers and cash advances are the greater of 4% or $5.

For more information, check out our full Amazon Prime Rewards Visa review.

Learn More About the Amazon Prime Rewards Visa

FAQs

Neither T.J. Maxx nor Synchrony Bank disclose a minimum credit score requirement to apply for the card. However, the general consensus is that you need a minimum score of between 620 and 640 for card approval. Naturally, the higher your credit score, the greater the likelihood of approval.

There’s no official answer to this question since neither T.J. Maxx nor Synchrony Bank publishes qualification requirements. We’ve already discussed credit score requirements above, but income is equally important. It’s safe to assume your fixed monthly expenses – house payment/rent and recurring debt payments – must be reasonable compared with your stable monthly income.

There is no published information on the minimum credit limit granted. However, a minimum of $200 has been reported from various sources. Regardless, credit card limits are determined by a combination of credit history and debt-to-income ratio. The issuer will also consider other factors, such as income stability and your payment history on related credit cards.

Yes. since your credit score and credit history are crucial to the approval process, a hard pull will be performed. Soft credit pulls are only used when a consumer is shopping for credit opportunities, but not for applying for credit directly.

Summary

The TJX Rewards Credit Card is worth having in your wallet if you spend regularly at T.J. Maxx, Marshalls, HomeGoods, HomeSense, and Sierra. The card allows you to earn 5% rewards for purchases at any store within the five brands.

But if you’re not a regular shopper of a store within the T.J. Maxx family, you will be better off using one of the TJX alternatives featured above, as you can earn rewards on all of your purchases, not just at the co-branded store.