Chase has some of the best credit cards on the market right now.

But there’s just one catch – you need to have pretty good credit. Technically, you need good or excellent credit to get it. Experian says a good credit score is a credit score above 700. An excellent credit score is when your score is above 800.

Even if you know your credit score, you might not be sure if your credit score qualifies as good or excellent. Or maybe you’re on the cusp and don’t want to risk it.

If you apply, your score will fall a little because of the hard inquiry.

Will the inquiry drop your good credit score into a “fair” credit score? Or your excellent score to just a “very good” score?

Does that mean you will be rejected for a card? Will the hard inquiry be a waste?

With so many question marks, you may not want to apply for a Chase card and risk it.

But there’s a way to find out if you can get the card without taking a hit to your credit score. There’s a way to see which cards Chase wants to give you.

🔃Updated February 2023 with the new Chase pre-approval tool. They replaced the pre-qualify tool with a pre-approval tool, which is a nice change. Now you know what cards you can get, rather than what you “pre-qualified” for.

How to Get Preapproved for Chase Card Offers

Technically, pre-qualified and pre-approved are two different things. In the past, Chase only had a pre-qualify tool. That tool has since been replaced with a pre-approval tool.

Pre-approved means you’ll definitely get the card, they already (pre)approved you. Pre-qualified means they probably will give you the card because you qualify for it based on what they know about you.

Either way, now it’s a pre-approval tool so there’s no ambiguity.

And to find out if you are pre-approved, you can use their tool!

- Step 1: Go to the Chase pre-approval tool and enter your details.

- Step 2: Click “Find my offers.”

- Step 3: Review the list of cards, these are the ones Chase has pre-approvedyou for.

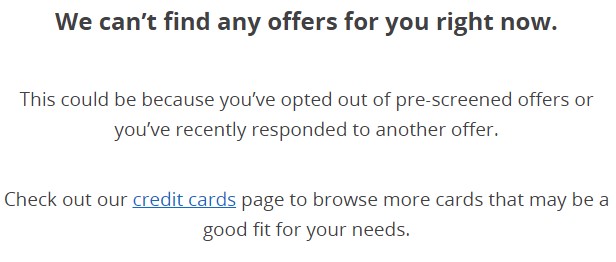

If you are not prequalified for any offers, you will see the following screen:

If you can’t see the image, it says:

We are unable to locate any offers for you at this time.

This could be because you’ve opted out of pre-screened offers or you’ve recently responded to another offer.Check out our credit cards page to browse more cards that may be a good fit for your needs.

That’s what I see because I’ve opted out of prescreened offers through www.optoutprescreen.com.

If you do see a card, remember that it means you are pre-approved!

They don’t pull a fresh report every time you ask, so your report may have changed since then and there’s no way to know (besides reviewing your report for yourself) when they may have last pulled it. So pre-qualification is only a good indicator of whether you’d get a card.

My Favorite Chase Credit Cards

I consider these four the best Chase credit cards right now for most people:

- Southwest Rapid Rewards Premier Card – a personal “best” because we live near a big Southwest airport

- Chase Sapphire Preferred Card – a great premium travel card

- Chase Freedom Card – a solid 1% cashback card with rotating categories for credit card reward optimizers

- Chase Freedom Unlimited – a no-frills cashback card with a new account bonus of Additional 1.5% cash back on everything you buy (on up to $20,000 spend in the first year) - worth up to $300 cash back .

More detail on why I like each:

Personally, my favorite is the Southwest Rapid Rewards Premier Card because it helped me get Companion Pass that much easier. There’s a sign-up bonus of $400 statement credit + 40,000 points after you spend $3,000 on purchases in the first 3 months of account opening.

Finally, you get 6,000 points on your anniversary and the annual fee is only $99, reasonable for a travel card.

Good to know on pre-approval – I’ve never done that, but I have started to run into the 5 / 24 rule (their prohibition on having more than 5 credit cards – including non-Chase – in 24 months). I’m assuming the pre-approval process would help flag that risk, though my spreadsheet has now been updated to optimize my timing 🙂 Thanks for the informative post!

Both my husband and I come up with no offers on chase although we have multiple chase cards and both have excellent credit. Possibly we opted out of getting offers at some point in time? Is there a way to check and find out?

It’s quite possible, you may have to contact them to find out for sure.