If the Truist name is new to you, its lineage features names you’re probably familiar with.

In mid-2019, BB&T and SunTrust formally merged to become Truist Bank. Today, you can see the Truist logo and purple colors adorning the various branches around the nation.

Before the merger, I wasn’t sure how they were going to be doing promotions. BB&T had some but SunTrust was by far the more generous bank. It appears that Truist will be closer to SunTrust level generosity and that’s a good thing.

They’ve become the 6th largest bank in the nation so you know they’ll want to grow even more and that means getting more deposits. No one wakes up and says “eh, 6th is good enough.” 🙂

And as you’d expect, they currently have a strong offering of $400:

💵 U.S. Bank – up to $450

Earn up to $450 when you open a new U.S. Bank Smartly® Checking account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through December 31, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

Truist Personal Checking Bonus – $400

Truist Bank Bonus Summary

- What you get: $400 cash bonus

- Who qualifies: AL, AR, GA, FL, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV or DC

- Truist $400 Promotion code: AFL2425TR1400

- Where to open: Online only

- How to get it:

- Open a Truist Bright, Truist Fundamental or Truist Dimension checking account,

- receive two qualifying direct deposits totaling $1,000 or more within 120 days of account opening,

- get a $400 bonus!

- When does it expire: 4/30/2025

Truist is offering a bonus that you can get $400 when you open a Truist Bright, Truist Fundamental or Truist Dimension checking account and receive two qualifying direct deposits totaling $1,000 or more within 120 days of account opening.

Open to residents of AL, AR, GA, FL, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV or DC. You cannot have an existing personal checking account with Truist Bank or have closed one on or after 10/31/23.

The Truist Dimension Checking has a $50 monthly fee but you avoid it by satisfying one of these conditions:

- Make $3,000 or more in total qualifying monthly Direct Deposits OR

- keeping a $10,000 total combined relationship balances linked across deposits and investments OR

- Linked personal Truist Credit Card, Mortgage, or Loan OR

- Linked Small Business Checking account

You can open this online or in a branch but you still need to meet residency requirements if you open it online. You must use the Truist $400 promotion code AFL2425TR1400 (it’s listed on the promotional page) to get the bonus.

Also, review our guide on bank account bonuses so you know what to look for with bonuses like this.

(Expires 4/30/2025)

Previous Truist Bank Promotion Codes

If you need to know what the previous codes are, here they are:

- For 2/1/2022 through 4/30/2022 – the promotion code was TR1CHK22B ($500 bonus)

- For the period ending 7/14/2022 – the promotion code was CHECKINGQ222 ($300 bonus)

- For the period ending 12/30/2022 – the promotion code was TRUIST1CHKQ422 ($200 bonus)

- For the period ending 4/14/2023 – the promotion code was CHKQ123TRUIST1 ($400 bonus)

- For the period ending 7/25/2023 – the promotion code was TRUISTCHKQ223 ($400 bonus)

- For the period ending 10/31/2023 – the promotion code was (again) TRUISTCHKQ223 ($300 bonus)

- For the period ending 10/31/2023 – the promotion code was TRUIST300Q323 ($300 bonus)

- For the period ending 2/27/2024 – the promotion code was TRUIST300Q323 ($300 bonus)

- For the period ending 6/26/2024 – the promotion code was TRUIST400AFL24 ($400 bonus)

- For the period ending 10/30/2024 – the promotion code was TRUIST400AFL24 ($400 bonus) (did not change)

- For the period ending 4/30/2025 – the promotion code was AFL2425TR1400 ($400 bonus)

As you can see, it’s been a long time since they offered a $500 bonus (back in 2022!), so getting $400 looks pretty solid.

Truist Business Checking Bonus – $400

Truist Bank has a $400 checking bonus when you open a new Truist Business Checking Account.

Open a Simple Business Checking or Dynamic Business Checking account online or inside a branch with the promo code SB24Q4CHECKING then – make qualifying deposits of $1,500+ into your new account within 30 days of account opening.

Check the terms of each account type for the features that meet your business needs. For example, the Truist Simple Business Checking has no monthly maintenance fee and includes 50 transactions and $2,000 cash processing included.

The business must have a physical address in AL, AR, GA, FL, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV or DC.

(Offer expires 3/31/2025)

About Truist Bank

Truist Bank is insured by the FDIC under FDIC Certificate #9846, which was formerly the certificate of BB&T. They are a Non-member Bank of the Federal Reserve System and headquartered in Charlotte, NC.

Truist Bank is the name taken on after SunTrust and BB&T merged back in 2019. At the time, they became the 6th largest U.S. bank holding company with over 2,000 bank branches.

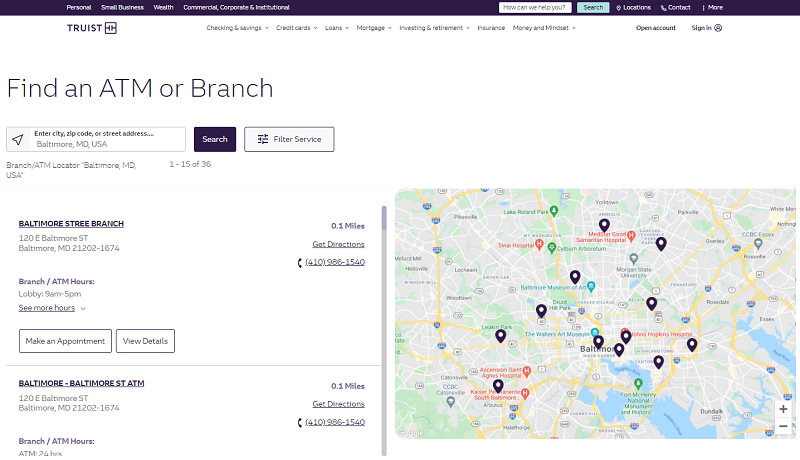

Find a Truist Bank Near You

It’s really easy to find a Truist Bank location, just use their bank locator. You will notice that after the merger, you get access to the previously SunTrust and BB&T locations throughout the country:

Truist Bank Routing Numbers

This can get a little tricky to look up because Truist Bank is a merger of two banks, BB&T and SunTrust. The ABA routing number you use will depend on where you opened your account. The simplest way is to look on your personal checks (see: how to find your routing number) but if you don’t have one, you’ll have to do a little sleuthing.

If you previously had a SunTrust account, the ABA routing number is 061000104.

If you previously had a BB&T account, your ABA routing number will be based on the state you opened your account:

| State | Routing Number |

|---|---|

| Alabama | 062203984 |

| District of Columbia | 054001547 |

| Florida | 263191387 |

| Georgia | 061113415 |

| Indiana | 083974289 |

| Kentucky | 083900680 |

| Maryland | 055003308 |

| New Jersey | 031204710 |

| North Carolina | 053101121 |

| Ohio | 042102267 |

| Pennsylvania | 031309123 |

| South Carolina | 053201607 |

| Tennessee | 064208165 |

| Texas | 111017694 |

| Virginia | 051404260 |

| West Virginia | 051503394 |

How Does This Bank Promotion Compare?

SunTrust has a comparable offer to what’s currently available. The $400 bonus is solid but the deposit requirement may be high for some people.

U.S. Bank – up to $450

Earn up to $450 when you open a new U.S. Bank Smartly® Checking account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through December 31, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

BMO Checking – $300

BMO is offering a $300 bonus* when you open a BMO Checking account and have $4,000 in direct deposits within 90 days of opening. It is a very straightforward offer that is available nationwide.

*Conditions apply

Bank of America – $300 Bonus Offer

Bank of America offers a $300 Bonus Offer cash bonus if you open a new account and Set up and receive Qualifying Direct Deposits* totaling $2,000 or more into that new eligible account within 90 days of account opening. Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer. It has a monthly fee that is easy to have waived.

Chase Total Checking® – $300

Chase Bank will give you $300 when you open a Total Checking account and set up and receive direct deposits totaling $500 or more within 90 days. There is a $12 monthly fee that is waivable with a monthly direct deposit of just $500, so no gotchas on this deal!

No matter which offers you choose, you walk away with a few hundred dollars for your trouble!

Heads up there’s regional restrictions for SunTrust

> The qualifying checking account must have a mailing address in the following states: Alabama, Arkansas, Georgia, Florida, Maryland, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, or the District of Columbia.

Yes, there are, like with many banks, you can only open an account if you live where they have a location. Thanks Ray!