When I was younger, I worked at a Chinese food restaurant for $5 an hour. I was paid under the table (shhhh!) so at the end of a four-hour shift, from 5 PM to 9PM, I was handed a greasy $20 bill and was told I could order a meal off the menu.

With inflation, that $5 an hour in 1996 would be worth $8.47 today. It’s actually a bit more because I never had to pay any taxes on it.

President Joe Biden announced the American Rescue Plan and in it, he called for the minimum wage to be raised to $15 an hour (also ending tipped minimum wage and sub-minimum wage for people with disabilities):

Raise the minimum wage to $15 per hour. Throughout the pandemic, millions of American workers have put their lives on the line to keep their communities and country functioning, including the 40 percent of frontline workers who are people of color. As President Biden has said, let’s not just praise them, let’s pay them. Hard working Americans deserve sufficient wages to put food on the table and keep a roof over their heads, without having to keep multiple jobs. But millions of working families are struggling to get by. This is why the president is calling on Congress to raise the minimum wage to $15 per hour, and end the tipped minimum wage and sub-minimum wage for people with disabilities so that workers across the country can live a middle class life and provide opportunity for their families.

It led me to wonder – is $15 per hour too high? Too low? Or just right? (I think indexing it to inflation makes sense no matter what the number is!)

Let’s compare it with a few other figures:

Table of Contents

Minimum Wage Adjusted for Inflation

The minimum wage was created in 1938 and one of the fascinating parts about it is that it’s not indexed to inflation. We set a number and then it just stays there until we set another, higher, number.

Here’s how much minimum wage was back then (courtesy of the Department of Labor), followed by adjustments with inflation to January 2021 dollar values (using the BLS CPI calculator):

| Effective Date | Minimum Hourly Wage | Minimum Wage (Inflation Adjusted to Jan 2021 Dollars) |

|---|---|---|

| Oct 1938 | $0.25 | $4.67 |

| Oct 1939 | $0.30 | $5.61 |

| Oct 1945 | $0.40 | $5.78 |

| Jan 1950 | $0.75 | $8.35 |

| Mar 1956 | $1.00 | $9.76 |

| Sept 1961 | $1.15 | $10.03 |

| Sept 1963 | $1.25 | $10.65 |

| Sept 1967 | $1.40 | $10.90 |

| Sept 1968 | $1.60 | $11.92 |

| Mar 1974 | $2.00 | $10.94 |

| Jan 1975 | $2.10 | $10.54 |

| Jan 1976 | $2.30 | $10.82 |

| Jan 1978 | $2.65 | $11.09 |

| Jan 1979 | $2.90 | $11.11 |

| Jan 1980 | $3.10 | $10.42 |

| Apr 1990 | $3.80 | $7.71 |

| Apr 1991 | $4.25 | $8.22 |

| Oct 1996 | $4.75 | $7.85 |

| Sept 1997 | $5.15 | $8.36 |

| July 2007 | $5.85 | $7.35 |

| July 2008 | $6.55 | $7.79 |

| July 2009 | $7.25 | $8.81 |

| Jan 2021 | $7.25 | $7.25 |

The last row, for January 2021, is meant as a reference point since the federal minimum wage has not changed since January 2009 – so the value of an hour’s work has continued to trend downward.

As you can see, workers at minimum wage earned the most, in terms of purchasing power, in the late 70’s. Since then, it’s just slowly trended downward with a few little bumps.

Minimum Wage as Percentage of Income

Looking at the minimum wage in today’s dollars only tells an incomplete picture – the CPI is a measure of just a small basket of expenses for a family. It’s meant to capture inflation but there’s more to it than that.

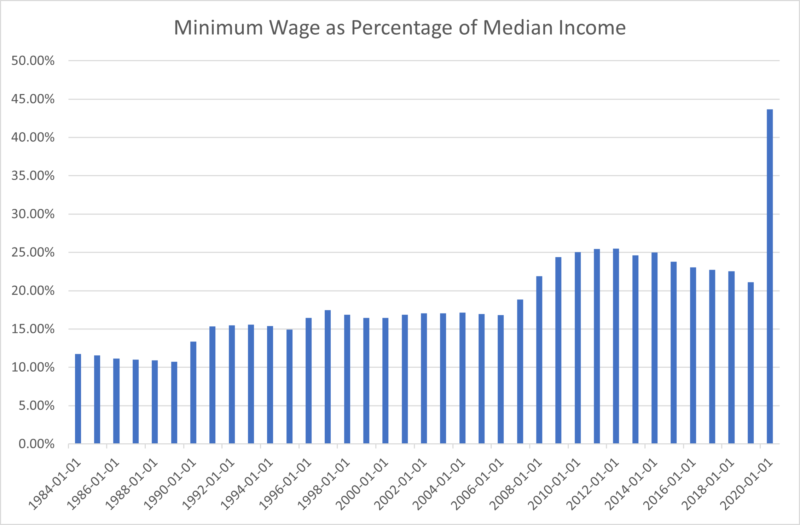

I was curious, how does the minimum wage compare to the median household income?

For that, we look at Real Median Household Income in the United States, courtesy of the St. Louis Federal Reserve. We will compare the January 2021 dollars as a percentage of real median household income calculated at an hourly rate (dividing it by 2,000 – the number of hours in 50 weeks of work).

The last bar (2020) is if we used $15 minimum wage and compared it to 2019 income.

The way I read this chart is that for years, at least going back to 1984, someone on minimum wage made around 10-25% of what the median income of a household. I suspect research will show that the number of dual-income households increased since 1984, which makes it even surprising that the chart is moving upwards.

What percentage would be appropriate? I don’t know but even at $15, the minimum wage is under 45% of what the median income is. To reach a median income, an individual would need to work two minimum wage jobs.

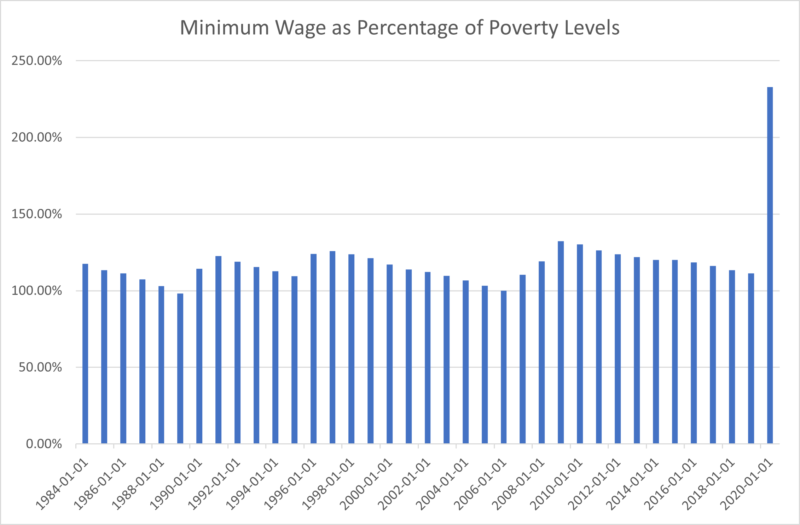

Minimum Wage as Percentage of Poverty Thresholds

This final chart will compare the minimum wage to the poverty thresholds used by many government programs to determine eligibility. The U.S. Department of Health and Human Services will issue poverty guidelines each year and we can calculate how a minimum wage would compare to these levels.

If we take the threshold for an unrelated individual, divide it by 2,000 hours, and compare it to the minimum wage, what do we get?

The last bar is for $15 minimum wage compared to poverty levels issued for 2021.

Minimum wage has basically hovered around the poverty levels, getting a slight bump every so often, and a $15 minimum would mean that everyone would be above twice the poverty threshold.

It’s also worth noting that the chart uses the poverty threshold for an individual. The levels are higher once you get into families.

Is a $15 Minimum Wage Too High?

I may not be looking at the right numbers to make this determination but my gut feeling is that $15 isn’t as massive an increase as it initially looks. There’s a bit of a cognitive bias at play too because going from $7.50 to $15 feels like we’re doubling minimum wage but comparing it to historical averages (adjusted for inflation), shows that what we’re really doing is fixing a slow slide down in purchasing power.

It’s also worth noting that many states have a minimum wage above the federal minimum wage. According to the Department of Labor, 29 states have a higher minimum wage (Washington D.C. has a $15 minimum wage though).

What do you think? Is a $15 minimum wage too high? About time we adjusted this again?

“Minimum Wage” is a misnomer. Regardless of the law, the minimum wage will always be ZERO – which is exactly how much you earn when you cannot get hired. The higher we raise the so-called “Minimum Wage”, the more folks will be earning the real minimum wage. Raising the “Minimum Wage” will only drive more employers to automate, be short staffed, or just close up shop. This has already happened in practice. Who actually expects to earn a living on their first unskilled, entry level job. Lets not remove the bottom rung from the economic ladder. Doing so will only… Read more »

Given a long enough time horizon, all companies will do this anyway – there’s automation everywhere and I believe that’s a bad reason to not raise the minimum wage.

People may not “expect” to earn a living but that may be the only job they can get.

Raising the minimum wage does nothing for those in poverty. The only way to raise someone out of poverty is to educate them and teach them a skill that allows them to earn more than a minimum wage. All raising the minimum wage is going to do is raise the wages of all the skilled workers proportionately, which in turn is going to cause mass inflation. As has been said previously in history “you can’t legislate people out of poverty .”

The argument that raising minimum wage will cause mass inflation is not as clean as many make it out to be. A lot of different things impact inflation and increasing wages doesn’t necessarily mean that another lever can’t be used to counter it. The Federal Reserve has a tool to limit inflation, the federal funds rate, and right now it seems like it would be more important to increase the purchasing power of those on minimum wage (to more accurately reflect historical averages) than it is to worry about the spectre of inflation.

I think we have to consider the fact that half of the minimum wage earners are below the age of 22. It sounds noble to give everyone a “livable wage” but a 17 year old working part-time at Chipotle messing up online burrito orders doesn’t need a livable wage. They need job expierence. Def have to keep this aspect in mind, but nobody wants to talk about this.

Where are you getting your statistics? According to this from the Bureau of Labor Statistics in 2016, workers under 25 represent 1/5th of hourly-paid workers with about half of those are paid minimum wage or less. Also, pointing out a single imaginary case (a “17-year-old who messes up your burrito”) is ludicrous.