Evergreen Money

Product Name: Evergreen Money

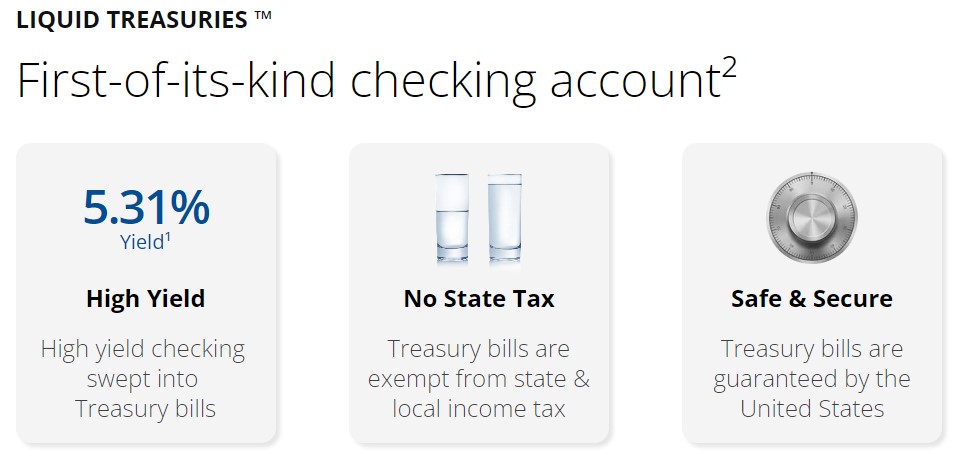

Product Description: Evergreen Money is a high yield checking account that sweeps your funds into Treasury Bills to get you a higher yield. The interest is exempt from state and local taxes, which makes the effective yield even higher.

Summary

Evergreen is a fintech company that uses the banking services of Coastal Community Bank. Founded in 2023 by Bill Harris, who founded Personal Capital and was CEO of PayPal, they offer a high yield checking account that leverages Treasury bills as an investment vehicle.

Overall

Pros

- High yield for checking account

- Interest is exempt from state & local taxes

- No incoming wires fee

Cons

- 0.03% monthly fee

- $10,000 minimum deposit

- Login with Passkey only

- No app

With interest rates at the highest they’ve been in over twenty years, we’re now seeing a lot of fintech companies offering banking services that look to increase yield by investing in Treasury bills.

Evergreen Money is the latest company to do this. They’re offering a high-yield checking account that puts your money into U.S. Treasury bills and then pulls them out when you access your money, such as when you swipe your debit card.

The yield is currently 5.31% APY but subject to change since they are being swept into T-bills.

Table of Contents

🔁 Update June 2024 to remove the $250 bonus that was no longer available. Previously, you could get $250 if you deposited $10,000 but that offer is no longer shown on the website.

Who is Evergreen Money?

Evergreen Money is a fintech so they are not themselves a bank, they get their banking services through Coastal Community Bank, FDIC insured #34403. Coastal Community Bank is one of those white-label banks that offer their services to fintechs you’re likely familiar with, like Aspiration, BlueVine, Prosper, Albert, etc.

Treasury bills are held in an SIPC-insured brokerage account with Jiko Securities. Jiko themselves offer a banking service that does something very similar, though their homepage just has a contact us form and is sparse on details.

Evergreen Money was founded by Bill Harris, who also founded Personal Capital (now Empower) and was CEO of PayPal and TurboTax.

Evergreen Liquid Treasuries

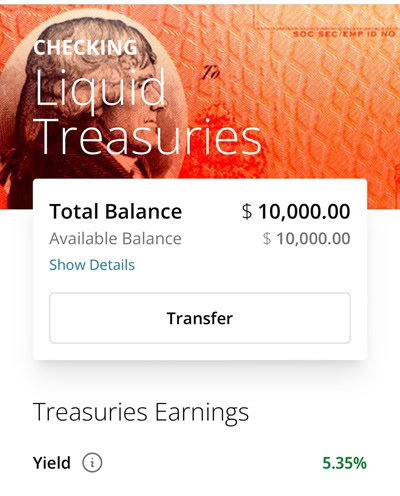

They have a checking product called “Liquid Treasuries” that offers a 5.31% APY – already a compelling offer on its own. They do this by sweeping your funds into U.S. Treasury bills to get the higher yield.

And, since the interest comes from U.S. Treasury bills, is is exempt from state and local taxes. In Maryland, the state taxes interest income at 6.00%. This means that a 5.00% APY that is exempt from state taxes is equivalent to a ~5.32% APY. It’s still subject to federal income taxes, but so is simple bank interest.

The account does charge a 0.03% monthly fee, which makes the annual fee 0.36%., and there is a $10,000 minimum deposit to open.

Those familiar with FDIC insurance are probably wondering how T-bills could be insured – they aren’t. The money in your checking account is insured but when it’s put into Treasury Bills, it’s moved to a brokerage account. That brokerage is covered by SIPC insurance and the bills inside are “guaranteed by the full faith and credit of the United States” with no limit.

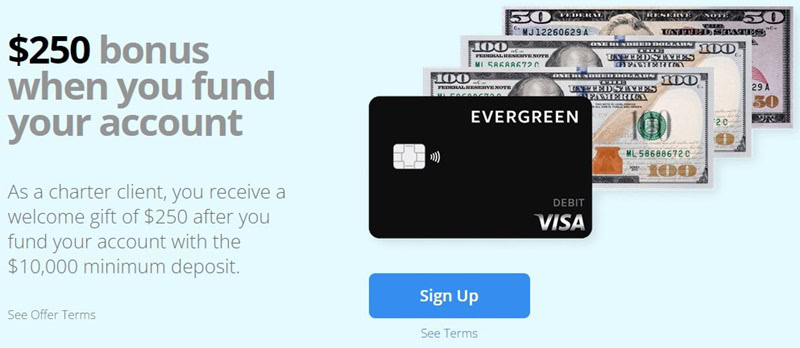

$250 with $10,000 Deposit [EXPIRED]

🚨 This offer is no longer available.

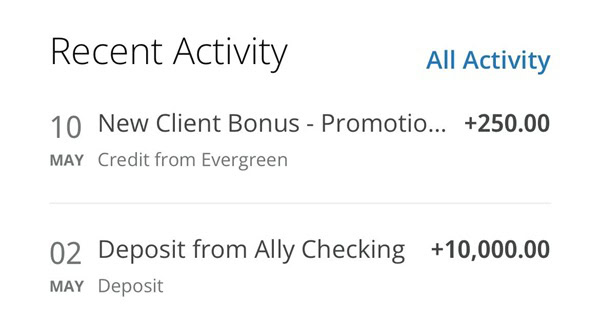

As a “charter client,” they are offering a $250 welcome gift when you fund your account with $10,000 (the minimum for an account anyway). You have until 6/30/2024 to take advantage of the offer and the bonus posts 15 days from the date of deposit.

The terms don’t say how long you need to keep the funds there to get the bonus (yet?).

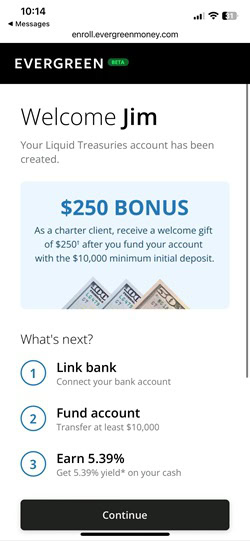

Evergreen Account Opening Process

You can start the process on a computer but then they ask for your phone number and the application continues there. They ask the typical questions you’d expect from a bank – name, birthday, address, Social Security Number, employment status, etc.

Once you get through that, you’re asked to link your bank and fund it with at least $10,000. The linking process did NOT use Plaid, which surprised me. They just have you enter your ABA routing number and checking account number.

There are transfer limits:

- Daily limit – $100,000

- Monthly limit – $250,000

If you want to transfer more, they tell you to contact Client Service.

And just like that, the Evergreen Checking Account is up. It took all of five minutes.

To complete the process of opening a Liquid Treasuries account, you have to verify additional information and send in one of the following:

- Lease Agreement (must be for valid time frame and signed)

- Mortgage (must be valid time frame)

- Deed (must be valid time frame)

- Bank Statement (must be last 45 days)

- Credit Card Statement (must be last 45 days)

- Utility Bill (must be last 45 days)

- Pay Stub (must be last 30 days)

I sent in a utility bill since that contains no sensitive information. I think this is for identity verification purposes though I’m not sure why a utility bill counts. I suppose it’s less annoying than asking me to take a photo with my government ID!

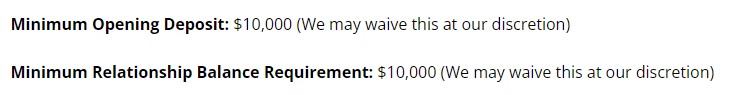

Is There A Minimum Balance?

The Checking Account Rates and Fees seems to indicate that there is a minimum relationship balance requirement of $10,000, that they can waive at their discretion:

I only deposited $10,000 and with the bonus of $250 and some interest, I’m only a few bucks above $10,250 right now. If I spend more than $250, do I trigger a fee?

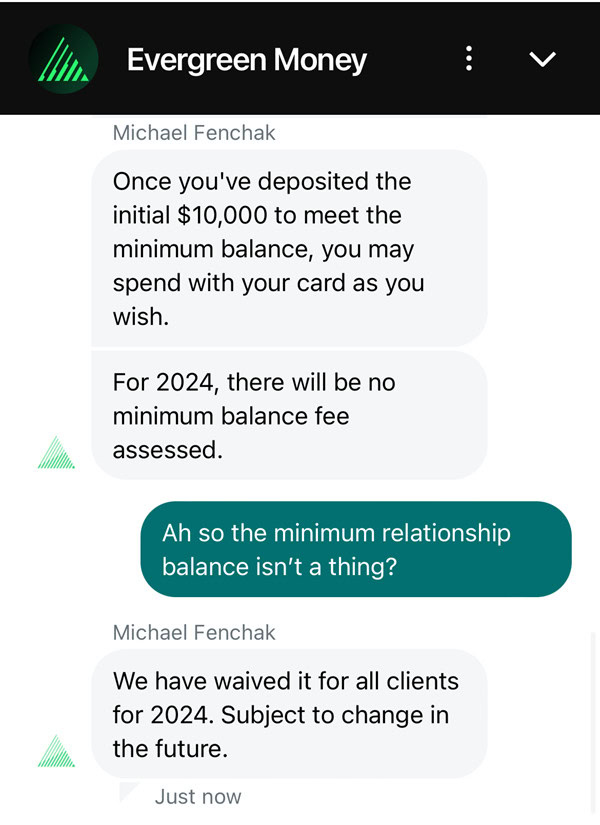

Not for 2024. This has been waived for 2024, according to service representative Michael Fenchak:

Login by Passkey Only

One weird quirk about Evergreen is that to login, you must use a passkey. No passwords!

I log in on my phone (yes, this violates my rules on secret email logins) and so for a passkey I can use my face.

It’s a little weird to not have an app or an email/password combination login. I’m OK with it but I can see how it could be a turnoff.

Transferring Funds

I opened the account on May 2nd and made a deposit the same day. It arrived on May 7th, three business days later which is typical for an ACH transfer.

The funds were immediately placed in the Liquid Treasuries Checking account so I was earning the promised 5.31% APY. No additional hoops, the funds are in the right place.

The bonus, which they say will be deposited within 15 days, arrived in just eight:

What are some alternatives?

This offer is unique in its simplicity – you get a high yield checking account that is accessible by debit card. I’m not familiar with any other fintech that offers this.

But if that flexibility is less important, this account is really similar to money market funds. If you compare this with your typical money market fund, like Vanguard Federal Money Market Fund (VMFXX), you get similar yields though not all of it is state and income tax exempt.

As of this writing, VMFXX has a yield of 5.28% with an expense ratio of just 0.11%, a third of Evergreen’s fee. 21.6% of its holdings are U.S. Treasury bills, 32.30% in U.S. Government Obligations, and the rest are in Repurchase Agreements. Not all of those are exempt from state and local taxes.

If you want an easy way to buy U.S. Treasuries, you could also look at Finvest. I don’t know much about them and haven’t used them but they popped up on my radar and I will take a look soon. Interestingly enough, they also charge a 0.03% per month fee.

Is this a good deal?

As long as T-bill rates remain high, it’s a good deal because the interest is state and local tax exempt. As rates lower, we’ll have to see how T-bill rates compare with other options.

In early 2024, Evergreen offered a $250 bonus if you deposited $10,000. It was nice, especially given how sparse the terms are, and getting a high yield with no extra effort is appealing. The fees are reasonable, considering how little work you have to do, and the yield is exempt from state and local taxes so it’s easily beating what I’m getting from by current bank (Ally, which has a yield of 4.00% APY).

For now, I thought it was appealing enough to get an account for myself.

I’ll update this post with any additional thoughts as I use the account.

opened account on phone the tried to sign in online but need to put passkey in usb port??? No app for them in playstore either? Cannot see my account online.

Yeah, they need a passkey but I used my phone. My face works as a passkey.

Thanks. I’m looking into this one also but was a little suspicious about putting $10K in. Looking forward to your updates on this post, mostly want to make sure you got piad the bonus and was able to get your dollars back

What made you suspicious about it?

Thanks for getting back. Mostly due to my own lack of knowledge about the company and… no contact information on the webpage, i finally found the live chat and got the phone number (these 2 things at first made by uncomfortable sending $10K at first) FDIC insured by Coastal Community (i called them and they confirmed they do partner with Evergreen) but then securities handled by Jenko Not many rules to it or min time frame to keep the funds in, almost seemed too good to be true, when I spoke to someone there, it also was seemingly too good… Read more »

Gotcha, yeah there isn’t much about the company but my thinking was that it’s with Coastal and they’re a known Banking-as-a-Service provider. Also, the founder also founded Personal Capital, which I use. Then again, if it were a fraud, they could’ve made that all up. I can see how the FDIC part and the SIPC part could be concerning, but Jenko is another one of those “banking as a service” providers (well, in this case, brokerage as a service). They’re not a household name though. By the way, I think your concerns are 100% valid and it’s smart that you’re… Read more »

I really appreciate your updates on this topic! Been following you for some time, thank you!

I appreciate you reading and sharing your thoughts too! 🙂

Hi Jim! Hope all is well. Was wondering, if you wouldn’t mind sharing, if Everything Money paid out the bonus for you after the 15 days. I ended up contacting Jiko and Coastal Community Bank and both confirmed they are partnering with EM, so maybe I was a bit overly concerned. I’m likely going to apply soon but thought I was dot all the i’s and cross the t’s by checking. Thanks for any input!

Yep, they paid it out within 15 days, I included a screenshot in the post above. It’s been good so far, nothing notable (which is good!).

Very nice. Thank you!

I also got paid, and verified I could withdraw money as well, no issues! No out of network ATM fees either, my Wealthfront account should be getting a little nervous 🙂

Only downside I see is no Plaid/Yodlee linking – I’m a sucker for an aggregator!

Plaid would make it more convenient but that integration costs money, so I understand why they would just use a traditional ACH.

On the trust of this website, went ahead and opened an account. To possibly save others a small inconvenience, Neo Banks (think Wealthfront or other startup types) don’t work as an external account with evergreen. Chase worked fine though. Support for that issue was very quick and the support person gave a direct number to me, they seem very responsive. The website is very generic though, and pretty sparse. You also can’t drop below 10k without being hit with a fee or risk closing, so I’d plan to keep at least 10k in there for a while. There are references… Read more »

Ahhh, so you can’t link another neobank with this one?

I do hate how “generic corporate” the website looks, almost to the point that you think it’s fake.

Right. It just failed attempting to add it without a clear explanation.

They said pushing from a neo-bank might work, so just the account linking is finicky

That’s so weird but good to know, I don’t have any other neobanks that I work with (I linked it to my Ally). I wonder why that is…

One other question, were you asked to fund the account before getting approval on it? Or you had confirmation that it was approved and then had ability to fund? Thx.

The whole process was so fast that I don’t think an approval was part of it, I think everyone is approved? They had to confirm identity after the fact, likely for KYC reasons, but they took all the information.

I see, thank you!

I set up an account last week. Evergreen would not set up a push transfer to either of 2 big banks or my local bank. They received a small transfer from my local bank, but I cannot withdraw from Evergreen. I will not send thousands of $ until I know I can withdraw. The CSR suggested I use the Debit Card. ha ha.

What happens when you try to withdraw?

Just wanted to let you know I opened an Evergreen account, started depositing money, but they have ZERO customer service, absolutely pathetic. Thru their chat, Email, or phone, they can’t answer one simple question. I’ve moved most of my money out of the account, and will remove the rest out tomorrow. I am limited by my other banks transfer limit, and Evergreen has no solution as to how to add an External account from their end. I don’t care if it was a $1M bonus, I won’t do business with such incompetent people and highly recommend you don’t refer others to them.… Read more »

I had success using their chat features but your experience sounds frustrating. 🙁

out of curiosity, if you don’t mind sharing, what was the question they couldn’t answer?

It seems this promotion is not available any longer – except for those who initiated account opening prior to June 15….

It seems like you are right, I don’t see it mentioned anywhere on the site anymore.

I just opened an account, but I had mistakenly thought it would be exempt from Federal as well as State and Local taxes, which doesn’t amount to that much savings for me…oh well.

Are they able to sweep any random amount in and out of T-bills into the checking account, or is it rounded up to a T-bill face value, with the balance kept in the checking account?

Sadly it’s just state and local taxes, T-bills are taxable at the federal level.

They sweep any random amount, it doesn’t have to be rounded up.